A small oversight with all your lawful predicament can cost you dearly. Don’t possibility it by depending on newbie information or sifting as a result of thousands of Google search engine results all on your own.

Just in case the guardians move away concurrently when you, It's also wise to involve a backup or reserve beneficiaries listing.

The objective with the SFRS for SE is to deliver some aid to modest entities from compliance Using the total SFRS, though guaranteeing quality, transparency, and comparability, which may gain the investment Neighborhood and other end users of monetary statements.

Mr Dennis Tan, Head, Client Economical Services Singapore, OCBC Bank, said: “We now have found news content articles reporting that individuals had been put off producing wills as These are worried about the complexity and charges. We wish to alter all of that by creating this seemingly cumbersome and expensive course of action a fuss-cost-free and cost-free-of-charge on the net expertise that is open to Absolutely everyone, especially our pioneer era citizens.

Command and influence – Board of the Singapore private trust company consists of a settlor, members of the family in addition to a trusted advisor. The settlor and family members private trust company singapore are specifically involved with the decision-earning process

Our Private Client workforce has just one goal – to deliver answers that will protect and mature your wealth now and for generations to return.

Supporting you realise your enterprise or own wealth ambitions is exactly what issues to us. Offering methods and overcoming obstructions is exactly what we do

Using a reputation for stability and reliability, Singapore trusts give a formidable Instrument for running wealth, preserving belongings, and attaining advanced fiscal goals.

Do Remember that in most cases trusts which include foreign trusts, international charitable trusts, and identical entities will be will writing service singapore qualified for exemptions, apart from particular international trusts mentioned singapore trust company in Section 5 on the Income Tax (Exemption of Revenue of Overseas Trusts) Regulations.

Specified income usually consists singapore trust company of curiosity, dividends, rental earnings and gains derived from outside Singapore referring to particular investments as well as distinct locally sourced expenditure earnings.

Trusts of this kind is often seen as a combination of testamentary trusts and residing trusts. Until finally a specific party or induce occurs, the trust continues to be dormant or inactive. When that trigger occurs, the trust singapore trust company gets to be operational, and assets are managed appropriately.

(vii) the original will should be made in an application for Grant of Probate when the Testator has handed away.

To maintain the status of a gorgeous small business hub and continue to be competitive, Singapore’s company tax rate has remained at 17%.

A revocation clause – A revocation clause is critical to ensure the currently penned will revokes any former wills. When thoroughly executed, the revocation clause makes certain that The present document will be the testator’s final testomony.

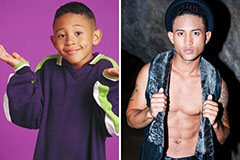

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!